Within the current challenging financial landscape, prosperous investing may often feel daunting, particularly for those going through retirement strategies, debt management, and tax strategies. This is the point at which the expertise of financial advisers becomes invaluable. These specialists play a critical role, offering counsel that helps individuals and families make informed decisions about their economic futures. Ranging from forming diversified investment strategies to assisting with estate planning, financial advisers provide personalized support adjusted to each client's unique circumstances.

Determining the appropriate financial adviser can significantly impact your financial well-being. Knowing https://social.muztunes.co/muzsocial-members/pumpinput91/activity/954349/ between various types of financial professionals, like financial planners and investment advisers, is important. If you are planning for retirement, managing a small business, or dealing with major life changes, recognizing the right time and method to enlist the support of a financial adviser can allow you to achieve your financial goals more efficiently. Throughout this piece, we will investigate the key insights that successful investors have learned from top financial advisers, making sure you are well-equipped to manage your financial journey.

Choosing the Right Monetary Advisor

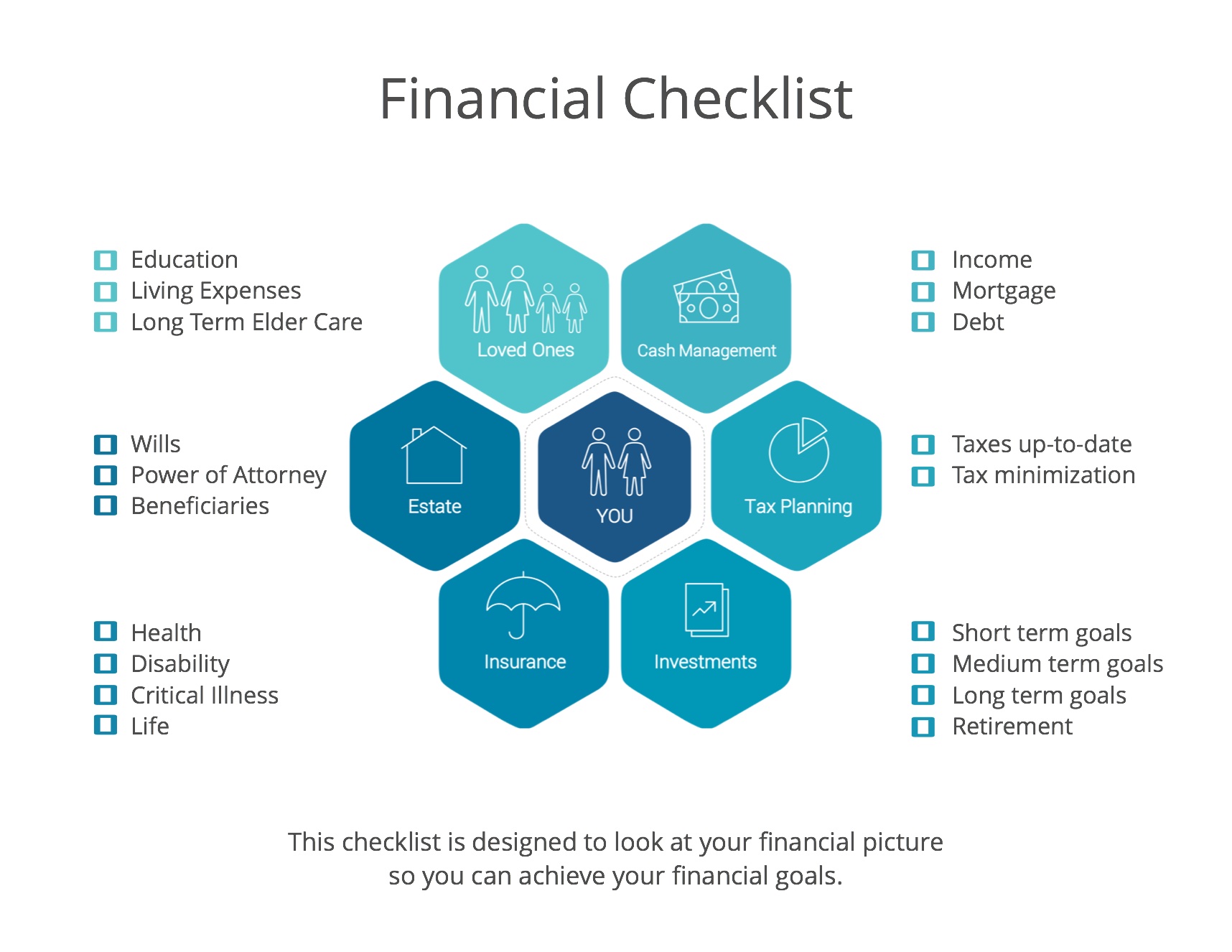

Choosing the right financial advisor is a key decision that can greatly impact your financial wellness. Begin by evaluating your specific monetary requirements and goals. Are you looking for assistance with retirement planning, tax strategies, or estate planning? Knowing what you need will help you find an adviser with the knowledge to fulfill those needs. Investigate prospective advisors by reviewing their qualifications, licenses, and fields of specialization. This step ensures that your chosen advisor can provide the necessary guidance tailored to your unique circumstances.

Then, think about the advisor's method to financial strategy. Some advisers concentrate on comprehensive methods, while others may specialize in investment oversight or specific areas like tax or estate planning. Search for an advisor who spends the time to comprehend your monetary goals and offers a tailored strategy. Arranging initial meetings can provide important information into their communication approach and how effectively they fit with your monetary viewpoint. During these meetings, pay attention to whether they are attentive to your issues and questions.

In conclusion, assess how financial advisers charge for their services. Pricing models can differ widely, including commission, fee-based, or a combination of the two. Fee-based advisors often offer more transparent pricing, as their compensation comes straight from the customer rather than fees on services sold. This aspect is important to consider, as it can affect the standard of guidance you get. A transparent fee model may result in a more trustworthy connection, enabling you to focus on your monetary goals without hidden costs.

Benefits of Working with Financial Advisers

Partnering with a money manager can deliver considerable advantages for people looking to improve their economic status. One of the primary benefits is tailored financial advice customized for each person’s particular needs and goals. Financial advisers take the time to grasp their clients' economic situations, goals, and risk tolerances. This tailored strategy aids individuals make wise choices regarding investment strategies, retirement planning, and wealth management , ultimately increasing the chances of achieving their financial objectives.

Another notable advantage is the expertise and insight financial advisers provide. They keep up with market trends, investment channels, and regulatory changes that can affect clients' financial plans. With their expertise and experience, financial advisers can help clients steer through complex financial landscapes, guaranteeing that they are well-prepared for obstacles such as market volatility or economic downturns. https://lowe-gupta-3.federatedjournals.com/the-reason-why-all-millennial-requires-a-financial-advisor-the-guide-to-intelligent-money-handling can enable clients steer clear of common pitfalls and make smarter choices about their finances.

Finally, financial advisers can extend comfort by functioning as a dependable ally in managing one’s financial affairs. This partnership not only offers confidence but also fosters accountability, as clients have someone to discuss with frequently about their financial plans. By working closely with a financial adviser, individuals can experience more confident about their financial future, knowing they have qualified support and support available to help them navigate life's financial complexities.

Traversing Financial Planning Strategies

When embarking on your financial path, it's essential to grasp the various approaches available to reach your goals. A monetary consultant plays a critical role in guiding you through these possibilities, helping you create a customized strategy that addresses your particular needs. From investment strategies to pension investment plans, they can advise on approaches that suit with one's risk threshold and time horizon, ensuring that you are ready to make wise choices.

Picking the right monetary strategy approach often revolves around one's individual conditions, such as salary level, personal stages, and monetary aspirations. Monetary consultants can help in building a varied portfolio strategy that balances danger and reward, including elements like equities, debt securities, and alternative investments. This even methodology not only aims to enhance profits but also mitigates possible risks connected with financial volatility.

When you reflect on executing these monetary tactics, it's crucial to keep open dialogue with your consultant. Frequent check-ins allow for changes based on shifting economic trends or life events, such as getting married, parenthood, or getting close to pension stage. Through actively collaborating with a financial expert, you can maneuver through the challenges of financial strategy and aim for achieving long-term monetary stability.